MEET Carol Tice: Carol Tice is a longtime business writer whose work has appeared in Entrepreneur, Forbes, Seattle Magazine, and many more. She writes the Make a Living Writing blog (http://www.makealivingwriting.com) and founded the writer community Freelance Writers Den (http://freelancewritersden.com). Below Carol Tice offers tips on starting a business on a shoestring budget.

WMI: Share some of your business background. Where have you worked, how did you gain your business knowledge, etc.?

CT: I learned most of what I know about business working two staff writing jobs for business publications. The first was a trade publication that covered hardware stores and lumberyards. I really learned it all from the hardware guys – margin, theft, labor, training, merchandising, promotions, marketing, the works. Also, my dad sold insurance as an independent agent, so I grew up watching him work super-hard getting meetings and selling prospects. He’d work all day, drive home and have dinner with us, and then drive out at night to take meetings in people’s homes.

WMI: What’s the name of the first business you owned? Tell us about the focus of the business, including who its target market was.

CT: I don’t know that it had a name! If it did, I guess it wasn’t very memorable. 😉

But after being a secretary at MGM for a few years, I started a home-based script-typing business that did very well. Eventually I was subcontracting work out to a couple of other typists.

WMI: How is running a business different from managing a freelance writing career?

CT: Well, being a freelance writer IS running a business, but it’s a solopreneur business and a very low-cost, simple one. If you have a computer and printer and one professional outfit to wear to meetings you’re about done. You can do in-person marketing and email and social media and it’s all free.

Operating my blog-based business now is completely different – I have a team of paid part-time staff and substantial annual expenses to keep my community members happy and my sites operating. Though it’s an online business, it’s much more like operating a retail store – I have staff and other costs as well, for software, among other things.

WMI: What percentage of new businesses run out of money within the first 3 to 5 years? Why do you think new businesses drain their financial reserves so soon after launching?

CT: The SBA reports that half of businesses go bust before the 5-year mark. Many businesses run short of cash because the owners just plunge in without doing any market research. They don’t know if there is a market for the product or service they want to sell, or if they have priced it correctly or given it the features consumers would want. Then they find out the hard way they’re off-base, and by the time they readjust, it’s taken too long and their cash reserves are gone. Often, they spend on big splashy marketing campaigns that are aimed at the wrong customer, or offering the wrong thing, and the money is just down the drain and wasted.

WMI: Is it really possible to launch a successful business on a shoestring budget, especially a brick and mortar business? And when you say shoestring budget, what money range are you referring to?

CT: It definitely is. Obviously, what “shoestring” looks like will vary for different business types. But, if you’re looking to go into retail, there are so many ways to start cheap if you are envisioning becoming a brick-and-mortar store. Don’t sign that 12-month lease right away! That has killed so many newbie retail entrepreneurs I know, and it is heartbreaking to watch. I live in a small town with only 30,000 population, and over 18 years I have watched so many startups die this way.

Instead, consider first renting a kiosk or cart in a mall – much smaller rent commitment. See if you could place your product on a big retailer’s shelves. Sell online at first to see if there’s a market. Rent a trade-show or community event booth for a weekend and see what response you get. Operate a food or retail truck you can move around to try out different locales. Rent a temporary or “pop-up” store during the peak season such as December, where there’s no long-term commitment. Sell in homes via a trunk show.

Experiment first with cheaper solutions than a store. Then, if you’re signing up for a store, figure out the tiniest footprint you could operate in and get a store that size. Too many entrepreneurs sign up for a big store with a big rent and that kills them dead, when they could have operated out of 300 square feet somewhere. Think of how tiny Mrs. Fields’ stores are in malls. That was a brilliant idea for how to lease cheap.

WMI: Name 3 to 4 start-up costs entrepreneurs can avoid, costs they generally think are necessary.

CT: Well, labor can be put off, often. Barter, trade services with other professionals to get what you need, do it yourself, or find a business-school student who maybe needs a project. Recruit family and friends if you need to bottle wine or conduct market research one day and reward them with some of your product. For instance, at one point when I was ramping my blog-based business, we cut every expense we could. We even discontinued trash pickup to save about $40 a month and drove our trash to the dump instead!

There’s a lot of paid software where now there are free versions you can use instead. Freshbooks for accounting is free for the first three customers, for instance. If you’re clever you could bounce from free trial to free trial for quite a while. There’s a lot of competition in software and a lot of good offers.

There are so many ways to do marketing free now. Put up a free Facebook page, use Twitter, do public speaking, to name just a few.

The big message of my book is: Look at every cost in your business and ask yourself, “Do I have to spend this money? Or is there some way this cost could be avoided, reduced, or postponed?” People tend to get complacent and accept a lot of costs as just something you gotta do to be in business, but often you could avoid it. The utility bill is a great example – often that can be cut in half if you switch to compact fluorescent bulbs, unplug computers at night, cut back hours of operation a bit, install automatic shutoffs on lights. I know retailers who’ve done it and halved their bill.

WMI: Tell us 5 specific ways the Internet can help a new business owner bring in revenue selling mostly online.

WMI: Tell us 5 specific ways the Internet can help a new business owner bring in revenue selling mostly online.

CT: Sure:

1) If you’re a consultant, set up a LinkedIn profile. I’ve been hired by three Fortune 500 companies off my profile, as a freelance writer. LinkedIn is the phone book of the 21st century for consultants and freelancers – everybody goes on there to do searches and find the professionals they need. Twitter and Facebook are also great tools for marketing a startup business, but if you’re only going to do one form of social media, make it LinkedIn. It’s the only platform where it’s understood that you are here to promote your business! Other platforms like Twitter and Facebook are trickier since it’s uncool to be selling on them.

2) Start a blog. Great way to keep your name going out there, build your authority, and bring new customers to your door.

3) Use location tools such as FourSquare or Google Places for Business if you have a physical location and want customers to be able to find you easily.

4) Operate an eBay or Etsy store.

5) I’d say the biggest way the Internet aids entrepreneurs is by helping you find collaborators, mentors, partners, and influencers who can help you. My blog-based business, Make a Living Writing and its related community site, Freelance Writers Den, would be nowhere today without the help of already successful online entrepreneurs I connected with online, primarily via Twitter.

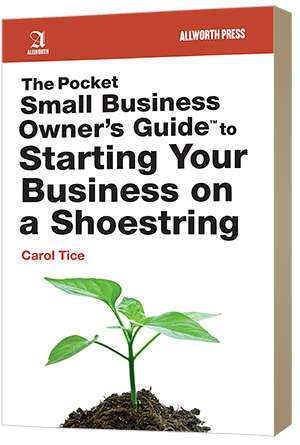

WMI: How much research did you conduct as you pulled together information for Starting Your Business on a Shoestring?

CT: Well, you could say I’ve been researching this book for 20 years! It has many stories from my years as a staff business writer, talking to hundreds of owners. It distills a lot of that knowledge into the money-saving tips. I did quite a few fresh interviews specifically for the book to make sure every chapter had at least one real-world example or story that helps readers understand how to implement the money-saving ideas or avoid overspending.

WMI: Tell us about the main topics or themes you cover in the book.

CT: It’s all about how to save money in your business. That’s it. Each chapter examines how you can save money in a specific aspect of business – labor, market research, marketing, e-commerce, and so on.

WMI: Do you share stories of other business owners in the book or do you offer entrepreneurs practical advice, steps they can start taking now to grow revenues?

CT: Both. There are dozens of stories of businesses that succeeded and many that failed, and what the owners did that determined the businesses’ fate. Lots of teachable moments there. 😉 As a purchasers, you also get a link to a downloadable workbook that lists all the tips and gives you room to take notes and brainstorm your own money-saving ideas.

WMI: Is it really true that successful business owners have a certain mindset? If so, what type of mindset, habits of thinking, do these people have?

CT: I think entrepreneurs never say die. They are wily, innovative, and willing to do anything to make their business survive and grow. You have to be an unstoppable force of nature to succeed in launching a business – when you encounter an obstacle, you never think, “I should quit now.” Entrepreneurs just find a way around and keep going.

WMI: Where can Write Money Incorporated visitors get copies of your book, Starting Your Business on a Shoestring?

CT: It’s on Amazon, Barnes & Noble, at indie bookstores and all the usual places, both as a physical book and for e-readers. The book site is http://shoestringstartupguide.com if you’d like to see reviews, the book trailer, and all the other goodies.

WMI: Do you have plans to write another book? If so, what will that book focus on?

CT: Not at the moment…still looking for the next great business-book idea.

WMI: What’s next for Carol Tice? Where would you like to see yourself and your writing career 2 to 3 years from now?

CT: I’m looking to put out a series of ebooks the rest of this year based on some 4-week boot camps I’ve put on for my writer community. I’m also looking to ghost books for CEOs. Other than that, just serving my Freelance Writers Den community and helping them earn more as freelancers – that’s my main focus.

You must be logged in to post a comment.